The trend to paid advisory services and unrestricted mandates means walking the tightrope for private banks. A new study shows how far they’ve come in adapting their business.

Mandates are what wealth managers yearn for because they allow them to elegantly deal with industry trends that otherwise bother the industry. Regulatory requirements, because the mandates include a concise statement of what is out of limits. Digitization, because offerings are easily structured and automatized. And price pressure, as mandates are a source of recurring fees.

No wonder therefore are the big players – such as Credit Suisse, UBS and Julius Baer – eager to lap up discretionary and advisory mandates. Listed firms have taken to regularly provide an update on the progress with such mandates as they are seen as crucial for the success of the private banking business.

Moving All Clients Into Mandated Relationship

Discretionary mandates are those where clients delegate the management of their portfolio in a trust relationship. The advisory mandate leaves control with the client, but the bank charges for its advice.

At UBS, Switzerland’s largest bank, 33.9 percent of all portfolios in global wealth management were mandated in the third quarter. Julius Baer, which also is based in Zurich, in the summer said it would strive get all its private clients to sign up to advisory mandates.

Double-Digit Growth

These are only signs of a trend. The real step forward in the attempt to better measure the development in the industry came when the Swiss Bankers Association and Boston Consulting Group (BCG) published a study on investment management activities in Switzerland.

The report included Swiss fund management as such, but also mandates with rich private clients and family offices.

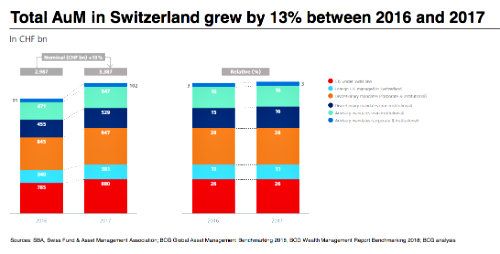

The figures are remarkable. Discretionary mandates for non-institutional clients included 529 billion Swiss francs ($534 billion) by the end of 2017, up 16 percent from a year earlier. Advisory mandates measured up to 547 billion francs, with a slightly lower rate of growth (see table below).

Contribution of Booming Stock Markets

It is not clear exactly how much of the assets measured would count as new money. Total assets under management in Switzerland increased 13 percent from 2016 to 2017. More than half of the increase was down to the positive development of equity prices.

The total of discretionary and advisory mandates with private customers in wealth management account for more than 1 trillion francs, the study concluded. A lot of money – no wonder the private banks want more of it.