Several private banks have been bought and sold in recent months in Switzerland and Liechtenstein. An overview of which companies have been active and reasons why consolidation will likely continue in 2019.

Five years ago, Zeno Staub (pictured below) made headlines with his forecast that a third of all Swiss banks would disappear. Exaggerated and arrogant were two of the words levelled at him by people active in the market. But the veteran head of Vontobel was absolutely spot on with his estimate: in Swiss private banking alone about a third of all players disappeared over the past five years . The industry includes some 100 institutes, compared with 140 in 2013.

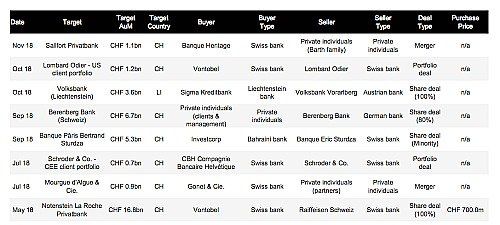

In 2018, consolidation again was a trend, even if the occurrence was slightly down. A list compiled by EY consultants shows that eight private banks have been bought and sold in 2018 (see table below). 2017 had seen 10 deals.

The Last Chapter for Notenstein

The first to move ironically was Vontobel, which in May acquired Raiffeisen unit Notenstein La Roche for 700 million Swiss francs ($706 million). With the bank it also received 16.8 billion francs in assets under management. CEO Staub, not known as a swift acquirer, landed the biggest coup of the year.

The deal also marked the end of a chapter of Swiss banking. Notenstein had been founded in an emergency move after Wegelin & Cie. folded during the tax dispute with the U.S. It was intended to provide a wealth management arm to Raiffeisen, Switzerland's third-largest bank. Notenstein in 2015 bought La Roche private bank and several fund businesses. Former Raiffeisen CEO Pierin Vincenz even toyed with the idea to merge with Vontobel.

The plans came crashing down in 2018. With the integration of Notenstein La Roche into Vontobel, some 200 jobs were cut and the name of the bank has disappeared.

And Another Owner Bank Disappears

- Page 1 of 2

- Next >>