Credit Suisse's spy scandal isn't the first time Swiss bankers have hit the headlines for behaving badly. finews.com looks back at the ten biggest fiascos in the Swiss industry's recent history.

1. Vontobel: Turbo-Banker and «You» Gravedigger

(Joerg Fischer, at left, and Hans-Peter Bachmann. Image: Keystone)

It was a scandal squared for Vontobel, and emblematic of the supercharged banking of the new Internet-based economy. The bank and then-Chairman Hans-Dieter Vontobel fell victim to what he later called «violation of trust and lies».

The perpetrators? Investment banker Hans-Peter Bachmann, finance boss Walter Kaeser, and Joerg Fischer, the Swiss bank's president. The trio first sank more than 250 million Swiss francs ($250 million) into an e-bank project («You») before it was buried. It later emerged that the trio had embraced other aspects of the high-flying times: they had purchased a sportfishing boat in the Cayman Islands, a helicopter, and were close to acquiring a private jet on the Zurich-based bank's dime.

Bachmann emerged as the brain behind the scheme: the banker had coordinated more than 40 initial public offerings for new economy start-ups. Among them was Think Tools, which reached a billion-franc valuation and drew in many of Switzerland's finance and business elite before disappearing in ignominy. Bachmann (and Vontobel) earned millions before the dot-com bubble burst and he, Kaeser, and Fischer left Vontobel in disgrace.

2. Credit Suisse: My Clean Slate

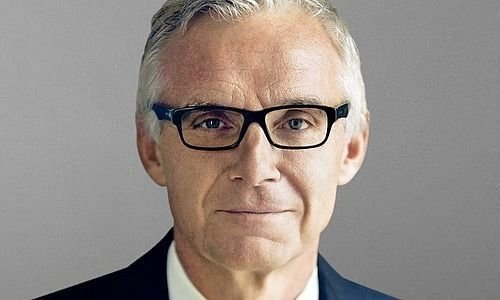

(Urs Rohner, Image: Credit Suisse)

In 2014, Credit Suisse pleaded guilty to criminal conduct in its dealings with U.S. wealthy, settling charges with a fine of $4.5 billion. Chairman Urs Rohner told a Swiss broadcaster «Personally we have a clean slate.» The comments rang hollow: not only had Credit Suisse just pled guilty to criminal charges, but it was also rebuked for shooting itself in the foot by making the investigation harder for prosecutors.

«We have internal rules to hew to the regulations of other countries,» Rohner said. He was «disappointed» that not all bankers had held to them. The comments are reminiscent of the «Teflon» banker’s most recent comments: that he found a covert spy operation on a departing executive «almost unbearable». Rohner never shed the impression that he preferred not to know the details rather than exercise a sense of responsibility.

3. Banking Secrecy: Good Luck With That

(Ex-finance minister Hans-Rudolf Merz, Image: Keystone)

«You’ll find banking secrecy too hard of a nut to crack,» Swiss finance minister Hans-Rudolf Merz told the European Union in March 2008. He didn’t know it at the time, but his warning turned out to mark curtains for Switzerland’s iron-clad confidentiality laws.

The depth of Merz’s short-sightedness became apparent just one year later, when Switzerland bowed to the OECD on a long-held distinction between tax evasion and outright fraud. With foreign investigators now free to pursue tax evaders with Switzerland’s help, secrecy was effectively dead. Swiss diplomats tried for a time to salvage the vestiges with financial kiss-offs (Britain and Austria were the only countries to bite). Today, Switzerland maintains extensive data-swapping arrangements, including with the EU.

- Page 1 of 2

- Next >>