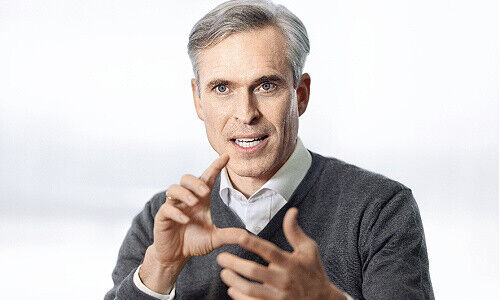

After a year of realignment, Philipp Wehle has flipped the switch in Credit Suisse's international private banking. In an interview with finews.com, he now details his growth plans with the bank's wealthiest private clients for the first time. He also invests in some of the bank's products himself and prefers to ride his bike to work.

Since the outbreak of the Corona crisis almost a year ago, Credit Suisse (CS) has recorded a third more client contacts in its international wealth management (IWM) business – mainly digitally and thanks to the IT tools that have become so popular. This closeness to its clientele enabled the bank to grasp the needs of its clients more precisely.

Against this backdrop, CS has accelerated its plan in recent months to integrate various services from investment banking more closely into wealth management. «Corona was an important impulse to rethink our business model,» says IWM head Philipp Wehle in an interview with finews.com.

New Area

This primarily concerns business with entrepreneurs of medium-sized companies, whose financial needs often mean that they neither fit properly into a traditional private bank nor have the critical size to be truly attractive to an investment bank. This is where Wehle stepped in and created the investment banking advisory (IB Advisory) department last year. The department currently employs 20 specialists and is set to expand to up to 50 people in 2021. It has already been active since 2020 for the Middle East, Russia, and other CIS countries and will now also be active in Europe.

Central to this plan is Germany, where CS plans to offer related services in Frankfurt in the future. A team of five advisers is to be ready in the first half of 2021, who are both skilled in serving very wealthy clients and at the same time understand the needs of investment and corporate banking. Finding such people is no easy task, as Wehle admits.

Investments of 150 Million

Overall, CS plans to invest up to 150 million Swiss francs ($169 million) in its wealth management growth initiatives, part of which will be achieved through efficiency gains in existing areas, Wehle said. In order to realize this savings target, he is not primarily thinking of job cuts but has already merged individual departments over the past year. He also wants to further digitize certain processes.

The new IB Advisory department is under the global co-leadership of long-time executive Babak Dastmaltschi as well as investment banker Christian Meissner, who recently joined CS and who for a while was also considered as the successor of UBS CEO Sergio Ermotti.

Turbulent Times

With this initiative, as well as other measures such as a focus on impact investing, Credit Suisse's IWM division is gradually taking on a new shape under the 47-year-old German. Wehle, previously chief financial officer at IWM, took the helm in early July 2019 during a turbulent time.

He replaced Iqbal Khan, who left the bank for UBS after a personal dispute with then CS CEO Tidjane Thiam. The conflict and the resulting internal uncertainty, which ultimately even led to Thiam's departure, was an extremely difficult time to develop the IWM business model further. And the fact that shortly afterward, in the spring of 2020, the Corona crisis broke out did not make the project any easier.

A Quarter of the Bank's Pretax Profit

There was a lot at stake. After all, Wehle's division employs about 10,000 people and manages around 800 billion francs in client assets. Measured in terms of profitability, it generates a quarter of the group's pretax profit (around 1.1 billion francs as of the third quarter of 2020).

In this respect, Wehle, who for the time being has been active under the radar in this unprecedented period, has been enormously challenged. While 2020 was the year of reflection and realignment, 2021 is now the year of implementation – execution, he notes. His department is also moving closer to its clientele in the Middle East, where Credit Suisse recently opened a branch in the Saudi capital, Riyadh.

Hoping for a Tailwind

While the first phase of repositioning the IWM division may have taken place under difficult conditions, Wehle can now hope for a tailwind. In Asia, the economy is recovering unexpectedly fast, which should also have a positive impact on Europe. In addition, the political change in the U.S. could release new impetus around the world.

In addition, since the Corona pandemic, many customers are reassessing their financial activities. Given these premises, Wehle believes that sustainable investing is not just a fashion or marketing trend, as long as it also serves an important purpose, as he explains in the interview.

Self-invested

In the meantime, he says, more and more (wealthy) customers are explicitly asking for sustainable investments, not as an end in itself or to ease their own conscience, but to make a difference – to have an impact; Portuguese customers, for example, who are committed to saving the oceans, or customers from Brazil who want to make a concrete contribution to saving the ecosystem. In some cases, they even wanted their own financial products to be developed in order to address their concerns more specifically.

Advising this clientele thus takes on a new significance, forcing a bank to team up with specialists, as CS does with Rockefeller Asset Management, for example. «I bought the kind of products that CS offers myself,» says Wehle, demonstrating a new self-image, especially since it has been proven in the past that it was a rarity for bank CEOs to equip their private portfolios with financial products from their own bank.

Biking to Work

Wehle's appearance may be rather reserved, but ultimately he is enormously determined and efficient, providing a credible counterpoint in a (financial) world of highly paced and sometimes overestimated managers. It is also fitting that he is not driven to the office by a chauffeur in a company limousine, but rather likes to use his bicycle.

Except now in the cold season. He prefers to take the tramway or sometimes walk when there is no lockdown. It's good for you, especially in these crazy times, he says with a grin.