The sharp conflict of interest between investment banking and wealth management is probably more responsible for the Archegos debacle than any failure of risk management, finews.asia's editor-at-large Andrew Isbester writes.

I am going to go out on a limb here – Credit Suisse’s mess for this week, Archegos Capital Management, does not look much like a failure in risk management at all. At least on the surface.

Although the losses are likely to be borne by the investment bank, I cannot imagine for a minute that its wealth management business did not have some form of individual banking relationship with Bill Hwang. And if it did not, you can be pretty certain that private bankers from that area of the bank were constantly trying to ingratiate themselves to him, his relatives, and others at Archegos – given it was essentially a family office.

Defense, Oversight and Culture

You can have the tightest risk management governance and best control systems in the world, but that will not change the massive conflicts of interest inherent when you bank billionaires while performing complex capital market transactions for them.

Look at Credit Suisse’s risk management disclosure in its 2020 annual report. It has all the usual stuff that all the other large international banks have about three lines of defense, oversight and culture, including a neat organizational chart showing the main management bodies and committees.

There is nothing here that separates them from any other bank at first glance. There is one committee that does sound rather unique, however, and that is the Position and Client Risk (PCR) committee, which sits under the Capital Allocation an Risk Management Committee, or CARMC.

Hundreds of Different Types of Risk Committees

And say that the matter of Archegos was discussed at that committee, or another one of the risk committees, over the past few months. Can you imagine what it would be like for your average risk management specialist to be in attendance?

Full disclosure: I worked at two and a half banks (it was being wound down) in different areas of risk, compliance and financial crime and have sat through, painfully, as secretary, member, and attendee at probably hundreds of different types of risk committees.

On the Back Foot

So there sits this rather hapless person, no matter how senior he or she is. Probably fully cognizant of the risks being taken and well-briefed but hesitant to say anything because, typically, under the three lines they are the second. That means they do not own the risk but are just responsible for policies and frameworks. I cannot tell you how many times I have heard risk management people say in the last decade or so that they do not own the risk – the business does. It gets really tiring for everyone, even the people saying it.

And if they do make a comment, it is usually not a very well-formed one. Why is that? Because everything they have seen related to that client or business they have seen from data, systems, emails and maybe a few informal discussions here and there.

The Client is a Billionaire

So, the meeting starts. You have one person facing up against the business, never more than one, as you want to emphasize how tightly your area manages costs. You always sit opposite more than one banker, at best three, ranging from senior to junior, probably one from the investment bank and another from wealth management or maybe a special function that combines both.

On their side, in their corner, invariably, is senior management, either as a chair or a member of the committee. And if the client is a billionaire, they are likely to have met him or her quite a few times before as well, probably over lunch or drinks. If they have, they usually let some comment slip about that.

Outvoted Anyway

Anything a risk management person says is effortlessly batted back by business and management. If you are on a tough committee, they usually do their utmost to make you feel foolish for even being there. And if the quorum is a simple majority, you are guaranteed to be outvoted anyway.

The only thing you can do is make sure that some well-formed comment or question is captured in the minutes accurately afterward, to make sure you can at least talk to the regulator with a shred of dignity at some point down the line.

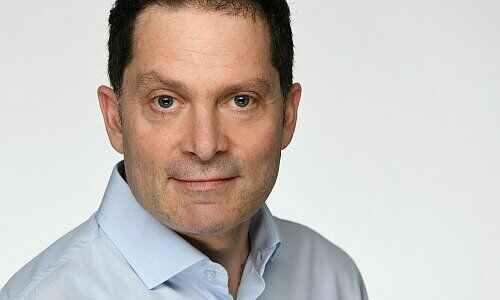

Andrew Isbester, a Swiss-British dual citizen, is an editor-at-large for finews.asia and finews.com, living in Hong Kong for 12 years. He spent his formative years in a number of countries including Argentina, Brazil, the U.S., Belgium and Scotland before returning to work in Switzerland in the 1990s and early 2000s as a correspondent and, subsequently, bureau chief for the international news agency «AFX News», which was part of «Agence France Presse» (AFP) and the «Financial Times». Following this, he worked in Zurich and Hong Kong for several major banks before resuming his activities as a journalist.