After reaching lofty heights last year, assets under management at Swiss wealth managers suffered from altitude sickness, falling from last year's peak. But one aspect is providing some oxygen.

At the end of last year, assets under management as many Swiss wealth management firms reached record levels, bolstered by large inflows of new money as well as extremely favorable stock market valuations. What a difference six months make.

Since the end of last year, however, the mountain of assets under management has been buffeted by the financial market turmoil, the war in Ukraine, and of course, high and stubborn inflation that central banks are now combating with higher interest rates. All that has served to severely impact asset prices, subsequently reducing the level of managed assets.

Impacting the Bottom Line

But that isn't all. One problem is that as income evaporates, costs can't necessarily be cut as quickly, particularly in the current environment where more than one negative trend is impacting the bottom line.

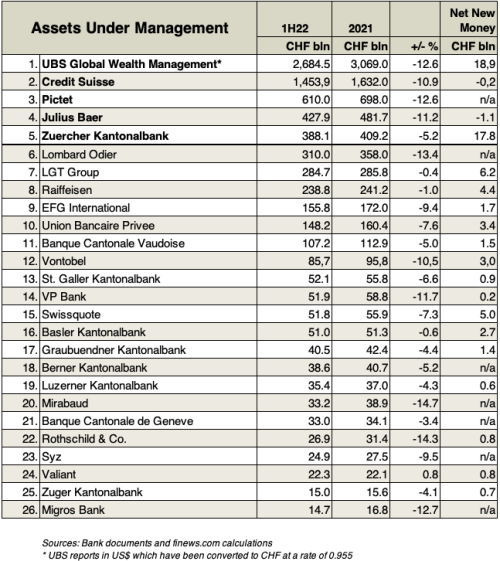

Assets under management declined at all of the financial institutions surveyed except Valiant. However, the declines vary between +0.8 percent and -14.7 percent. This discrepancy again depends on the new money collected in the reporting period; the more there was, the smaller the decline in assets under management.

Whiff of Oxygen

The strong figures for Raiffeisen banks and Zuercher Kantonalbank are noteworthy. Both are brands that go down well with clientele in times of crisis. LGT Group also reporting a considerable volume of new money as of mid-2022. Despite the drop in AuM at so many wealth advisors, one aspect that is providing a whiff of oxygen is net new money flows. To be sure, new money flows also reflect clients pulling assets out of accounts for various reasons, but the overall figures are still instructive.

Clearly, nobody likes to lose money, but wealth managers take a longer view of markets and often plan in terms of generations rather than according to a quarterly calendar. So the stock market sell-off, while painful, also provides an entry point into investments that wealth managers like to hold for a very long time.

New Money Flows

To see how this has impacted Swiss wealth managers, finews.com looks at the midyear results of several firms in terms of their overall assets under management and new money flows. The rankings below show their performance, although it also should be noted that some of the firms with very large AuM such as J. Safra Sarasin and Pictet do not provide mid-year figures.

(Click to enlarge, sources: half-year reports 2022)

UBS Reports Third Quarter Inflows

At a conference on Tuesday, the co-head of UBS's wealth management business, Iqbal Khan, said that «as of this quarter we are seeing positive flows», according to a report from «Reuters». While he did not offer more specifics, it could be an early indication that investors are taking the opportunity to add to, or enter into, positions as asset prices have plunged in recent months.

Demographic Shifts

On top of all that, there are demographic shifts to take into account. Switzerland remained the world's number one in cross-border wealth management in 2021, and total assets under management grew 10.9 percent last year to around 2.4 trillion Swiss francs ($2.6 trillion), according to the report.

But a report from Boston Consulting Group (BCG) in June predicted that in the next four years Switzerland will fall out of the world's top three financial centers, into the fourth position behind the US, Hong Kong, and the UK. Swiss financial assets are expected to grow 2.8 percent by 2026.

At a recent press event, Martin Hess, the head of economic policy for the Swiss Bankers Association SBA noted that asset growth in China has been «phenomenal» and it isn't a case of Switzerland losing its attractiveness but rather that the «Chinese are getting faster than Europeans.»

Higher Interest Rates

With central banks now raising interest rates, that could provide additional income for wealth managers. In an interview with finews.com earlier this year, Mirabaud Senior Partner Yves Mirabaud said that although higher interest rates won't bolster current markets, it's more healthy for the bank to have positive rather than negative interest rates from central banks.

«There is a huge hidden value if rates go to two, two and a half percent. But on the other side, higher rates have, as we can see, a negative impact on market valuation,» says Yves Mirabaud at the time.

In June, the Swiss National Bank (SNB) raised its benchmark interest rate by 50 basis points to -0.25 percent, prompting several banks to end their policy of charging clients for cash balances over a certain level. Hess said that the current negative SNB rate «won't remain that way for long» and the end is in sight, but won't mean that we will find ourselves in «a phase of high-interest rates.»

End of Negative Rates

This week, the SNB is expected to finally exit the era of negative interest rates. The discussion is not whether it will raise rates, but by how much. Either way an increase of 50 0r 75 basis points will finally bring positive interest rates to Switzerland once again, as finews.com reported.

Banks seemed to anticipate the change, and increased the duration of fixed-rate mortgages, by 30 percent with a remaining duration of over 5 years. The average domestic mortgage interest rate fell to 1.21 percent from 1.28 percent in 2021, and with that, the «floor has been reached,» according to Hess.

That might provide an oxygen mask for AuM to make another summit attempt.