Swiss private banks aim to cash in on consultancy as other ways of making money have dried up. The lack of transparency in the fee structures is making this difficult, according to a study seen by finews.com.

The world of Swiss asset managers was thrown out of kilter in 2012. It was then that the Federal Supreme Court ruled in favor of an investor seeking reimbursement of fees from UBS for sale of financial products. Since then private bankers have desperately been trying to earn money from consultancy services, which investors previously had received for free.

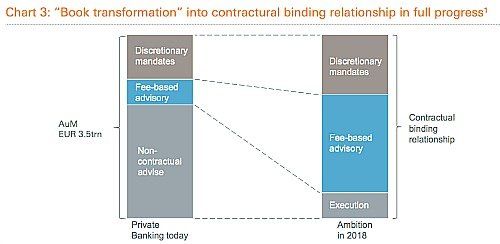

The adaption to life with the «booking transformation» since 2013 has not been too successful, a study by Deutsche Bank subsidiary DWS on the Swiss market concluded – a study seen exclusively by finews.com.

The Greater the Asset, the Bigger the Price Gap

The DWS report «Paying for investment advice – a private banking revolution» shows that on average a quarter of private banking clients are bound by discretionary mandates. The forward-looking consultancy-fee model shows only every eighth wealthy client is on a fee-based mandate, though the goal for 2018 was to have more than half of such clients tied to a fee-based contract (see graphic below).

Thus the timescale for the fee transformation is extremely tight, which has meant banks resorting to radical measures. DWS calculations suggest current fee practices are still not transparent and confusing.

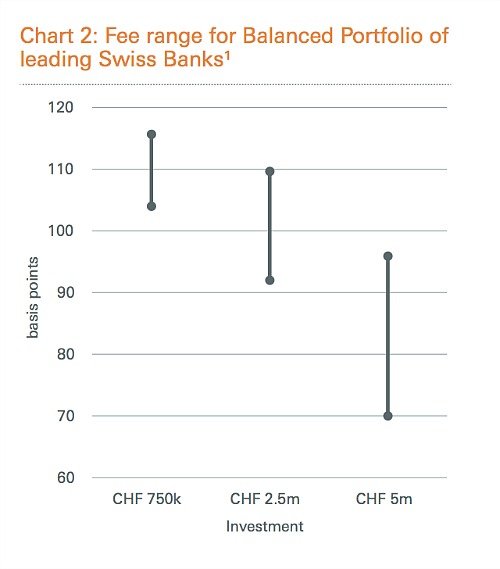

For a weighted portfolio worth 750,000 Swiss francs, with two transactions per month at 2 percent of the total value, the average fee generated is 111 basis points (see graphic below). The difference between the cheapest and costliest offer is thus 11 basis points. However if a client were to invest 5 million francs under the same conditions, the fees drop to an average of 87 basis points, pushing the gap between the two offers to 25 basis points.

Biggest Transformation in Recent Years

To put it bluntly: the more assets they invest at a bank, the greater is the danger of higher fees. This is due to the new all-in-fees, which are often only profitable for active traders.

Private banks seeking to sell credible advice to clients cannot afford not have a transparent fee structure. The ultimate goal of the industry is to tie clients into contractual deals, and provide the best tailored solutions for assets and services.

«Delivering modern consultancy at a defined price,» the DWS authors claim, «means one of the biggest transformations to which the industry has been exposed in recent years.»

Hard-Nosed Approach

In reality, expectations are growing fast. Investment advice is no longer enough. What is required is comprehensive asset planning, which takes into account the personal situation of every client. Bankers also need to be able to sell convincing investment stories, and open digital channels to investors, which in turn requires investment in new technologies.

Finally bankers must learn to become more hard-nosed: clients without discretionary or advisory mandates should not be allowed contact with bank advisers in the new world of private banking.

Private Banking: Planning Success

This transformation is expected to demand much from small- and medium-sized private banks. Plenty remains to be done to achieve success. Future consultancy mandates will rely less on the ups and downs of the markets, and will bind clients closer to the bank.

All this should make asset management a better planned business. The best of this is that Swiss banks are ahead of their foreign rivals in the transformation process, thanks largely to the decision of the Swiss Federal Supreme Court in 2012.