The chairman of Credit Suisse confirmed he will leave in one year's time. The move ends lingering uncertainty after a damaging spy scandal.

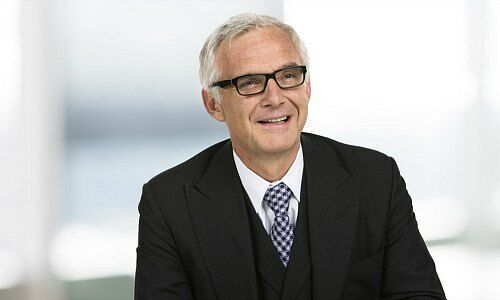

The Swiss bank's shareholder meeting next month will be the last time Chairman Urs Rohner stands for reelection, Credit Suisse said in a statement on Wednesday. Next year, term limits of 12 years would kick in for Rohner, a 60-year-old lawyer who joined the bank as its chief counsel in 2004.

«Urs Rohner has confirmed to the board a long time ago that he will not stand for re-election at next year’s annual general meeting,» the bank said. «The governance and nominations committee is leading the succession planning process for this role, which is well underway and progressing according to plan.» This body is led by Rohner.

On the Outs

Rohner, who is on the outs with Credit Suisse's biggest shareholder over the handling of a spy scandal under ex-CEO Tidjane Thiam, reportedly lobbied for more time with weighty investors. When Thiam was ousted last month, Credit Suisse also flagged the exit of Rohner in 2021.

Also last month, Alexander Gut, a weighty director who some observers had pegged as a candidate to succeed Rohner, said he will leave the board. Gut is the son of Rainer Gut, the long-standing former Credit Suisse leader who remains honorary chairman.

Lightning Rod

Rohner's deputy, Roche boss Severin Schwan, also ruled himself out for the job, in an interview with Swiss daily «Tages-Anzeiger» (behind paywall, in German). Rohner joined Credit Suisse's board in 2009, directly from his former job as Credit Suisse's chief lawyer after losing the CEO job to Brady Dougan, who ran the Swiss bank until 2015.

Rohner, who advanced to chairman in 2011, has long been a lightning rod. Since last year's shareholder meeting, Rohner has taken home a salary of 3 million Swiss francs ($3.1 million) as well as a «chair fee» of 1.5 million, paid in Credit Suisse stock.