Larry Fink's calls for investors to go green reverberates through finance. The urgency of his plea is undermined by Blackrock falling short with its own behavior.

Investments hewing to so-called ESG criteria – with specific requirements of environmental, social, or governance aspects – are poised to continue their boom, as big economies like the U.S. integrate recovery efforts with longer-term carbon emissions reduction, according to a study last week by Moody's.

That's music to the ears of asset managers which have increasingly swooped into the niche. The «green wave» represents a chance for partial atonement for a financial services industry that still suffers from a reputation battered during the financial crisis of 2008/09.

Prominent Swiss Backers

The pandemic is driving demand, with 88 percent of executives flagging an increase in demand among institutional investors for funds with an environment tilt, in a survey released on Monday by Cerulli Associates. With $8.7 trillion under management, Blackrock is the goliath of the niche.

The U.S. asset manager was the first to publish ESG ratings of the companies held in its exchange-traded fund business, iShares, and Swiss CEO Miriam Staub-Bisang is a vocal proponent (she is also a senior adviser on sustainable investing). Blackrock vice-chairman and ex-central banker Philipp Hildebrand is another long-time backer – even making it a key pillar of his candidacy to oversee the OECD.

Upping The Ante

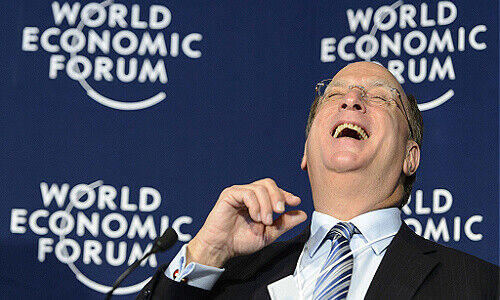

Blackrock upped the ante last month, when co-founder and CEO Larry Fink basically made ESG an imperative, in a widely-read annual letter. Sustainability is the «top issue» for investors, he noted, pledging that Blackrock will stop plowing money into stocks of companies at high-risk, like coal producers.

Fink's words carry weight on Wall Street but also globally: Blackrock owns between three and five percent of all but two of Switzerland's blue-chip companies, for example (Roche and Swatch, which both maintain a dual share structure favoring their family-owners, are the exception).

Vast Global Influence

Switzerland is emblematic of the New York company's influence as a major investor outside the U.S. thanks to its sheer heft. Fink's pledge, while laudable, opens Blackrock open to criticism that it is isn't fulfilling its own standards – preaching water while drinking wine.

Some of Blackrock's funds don't pass muster as «green,» according to fund industry tracker Morningstar: many of them are still invested in fossil fuels like oil, as the «Financial Times» (article behind paywall) recently criticized. Morningstar gives Blackrock overall the second-worst rating – basic. Morningstar points out that most asset managers, not just Blackrock, will have to dramatically shift their portfolios if they are serious about «greening» their investments.

Lack of Governance

ShareAction arrives at a similar conclusion: Blackrock is part of the second-poorest group on environmental, social, and governance themes, the British non-profit for responsible investment found in a study of 75 major asset managers. Blackrock put in a poor showing across the board in responsible investing, climate change, human rights, and biodiversity to land in 47th place, according to ShareAction.

Robeco topped the ranking, followed by BNP Paribas' asset management arm, and Legal & General's investment management unit. Many funds that call themselves «green» don't actually fulfill the criteria, as German daily «Handelsblatt» (behind paywall, in German) pointed out this week. Many, including Blackrock's index funds but also UBS, still hold up to five percent of companies involved in fossil fuels.

Fink claimed the spotlight with his call, which is undermined by a key pillar of ESG, Morningstar analyst Ali Masarwah notes. While environmental and social criteria have been in focus, Blackrock has been conspicuously absent in exercising its governance rights by voting its shares for climate proposals at annual meetings, Masarwah notes.